Keeping our eyes on the horizon to ensure business sustainability

Addressing risks in challenging times

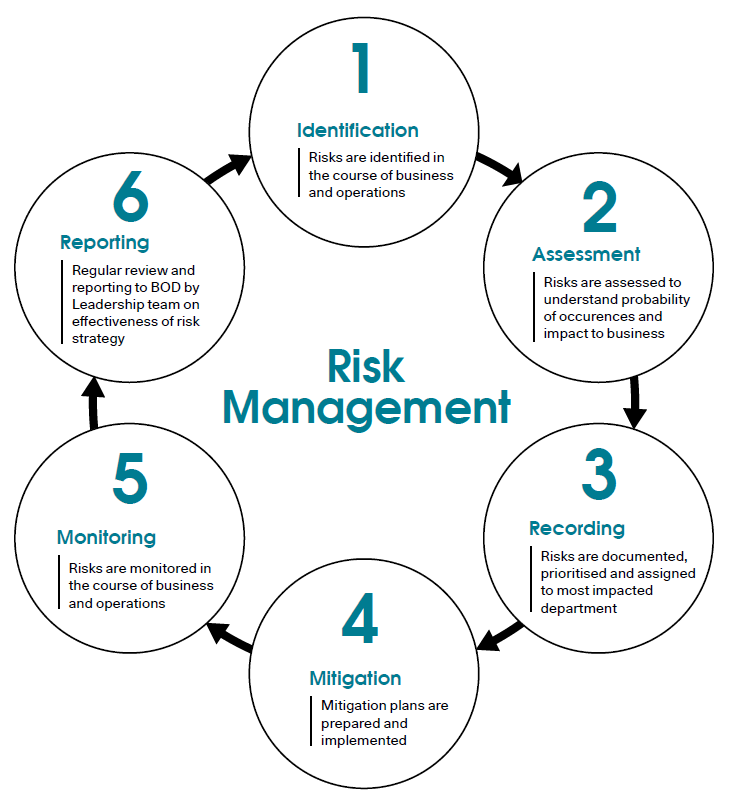

Risk management is not just a matter of compliance and good governance. It is fundamental to our decision-making process at every level of the organisation. Our risk strategy and policy determine how we plan for and react to risks related to our corporate strategy, preventable incidents from operations, and unexpected events.

BW LPG adopts a comprehensive and systematic approach to identify, measure, prioritise and respond to risks challenging our most critical day-to-day operations. Our Enterprise Risk Management (ERM) is based on the principles from ISO 31000 and the Committee of Sponsoring Organisations’ (COSO) ERM Framework. Through effective risk management, BW LPG aims to maximise value through an appropriate balancing of growth, return, risks and resource deployment strategies.

To pursue sustainable development and growth, we have also integrated climate-related physical and transition risks into our ERM framework. This also provides information for our stakeholders to understand the risks, impacts and opportunities that climate change brings to BW LPG.

Enhanced reporting in alignment with major frameworks

Our ERM describes all relevant risks related to our business, including Environmental, Social and Governance risks. Our reporting is aligned with the framework from the Task Force on Climate-Related Financial Disclosures (TCFD) that looks at risks and opportunities from the global transition towards low-carbon or carbon-neutral solutions, and physical risks from changing weather patterns.

A TCFD-aligned approach

We identify and conduct risk assessments in alignment with TCFD by:

- Engaging customers, investors, and lenders to understand possible risks to our business and operations;

- Monitoring developments in international standards and environmentalregulations in shipping; and

- Identifying and managing climate-related and business risks within our ERM framework.

The TCFD and us

The TCFD guides our understanding on risks and opportunities that may arise from climate change. In the near term, we continue with proven, secured income strategies and organisational transformation. These include an emphasis on pioneering technology and digitalisation of our fleet, and commercial agility to meet evolving market needs.

Decarbonisation trends in the long term present risks and opportunities. Changes in LPG market fundamentals and growing demand for climate action pose the greatest risks to our industry. They also present opportunities to expand and evolve business offerings along the energy value chain. We monitor developments in carbon taxes, carbon capture, green technologies, green lanes and regulations as we develop our ESG strategies.

What we have done

Risks and opportunities are prioritised based on severity of potential impacts, and feasibility respectively. Our Supplementary Risk Assessment document provides a summary of our comprehensive risk assessment.

Management focuses on transition risks in strategic planning, fleet development and capital expenditure plans. These risks also drive our next-generation and existing fleet transition planning. Physical risks from climate events influence voyage planning and operations.

BW LPG’s Decarbonisation Roadmap includes investing in vessels that have lower GHG emissions and higher energy efficiency. Regular ESG reporting also facilitate competitive financing which are linked to ESG performance metrics, translating into cost savings and improved risk management.

BW LPG is a pioneer in the use of lower-emissions LPG propulsion technology, and we are committed to the use of LPG as a sustainable transition fuel as we work to meet the IMO’s 2050 ambitions.

What we will do

At BW LPG, we will strengthen our management of climate-related risks with quantitative evaluation and scenario analysis, we will ensure commercial and corporate agility to seize opportunities created by the global energy transition, and we will assess implications of long term trends to ensure our relevance and business sustainability.

Internal checks and balances

Internal audits complement stringent and transparent reporting at BW LPG. The Internal Audit team is an independent funcion that reports directly to the Audit Committee, and the team has the mandate to review business activities including but not limited to large-scale investment projects, ethics compliance, and processes related to anti-corruption and anti-bribery, safety and security, supply chain and human resource management. It reviews the adequacy of internal controls and risk management processes of the organisation. Their findings and recommendations are reported on a quarterly basis to the Audit Committee.

We have an authorisation matrix that outlines the functional and financial approvals required to execute transactions. This is a significant part of our internal control structure to ensure contracts and transactions are thoroughly evaluated. Payment transactions are also subjected to tiered approvals.

We also have a risk scoring framework to understand existing and emerging risks. Red flags are identified to provide a clear and methodical approach and guide all employees in assessing business risks. To assess business partners, we conduct due diligence annually, and where applicable, we request for recognised certifications and standards.

Read More

- Read about LPG and its benefits at The World LPG Association.

- Read about the benefits of LPG as marine fuel.

- Read about our industry participation and sharings.

- Read about IMO’s initial GHG strategy.

Topics: risks, ESG, environmental social and governance, ERM, enterprise risk management framework, International Maritime Organisation, decarbonisation, task force on finance-related climate disclosures, TCFD