A Record Quarter

2023 has started very strongly on the shipping side. And with an expanded fleet through our pool vessels, we have positioned ourselves to benefit from this strong market and capture value for our shareholders. Our Product Services division also delivered a solid first full quarter as an expanded team.

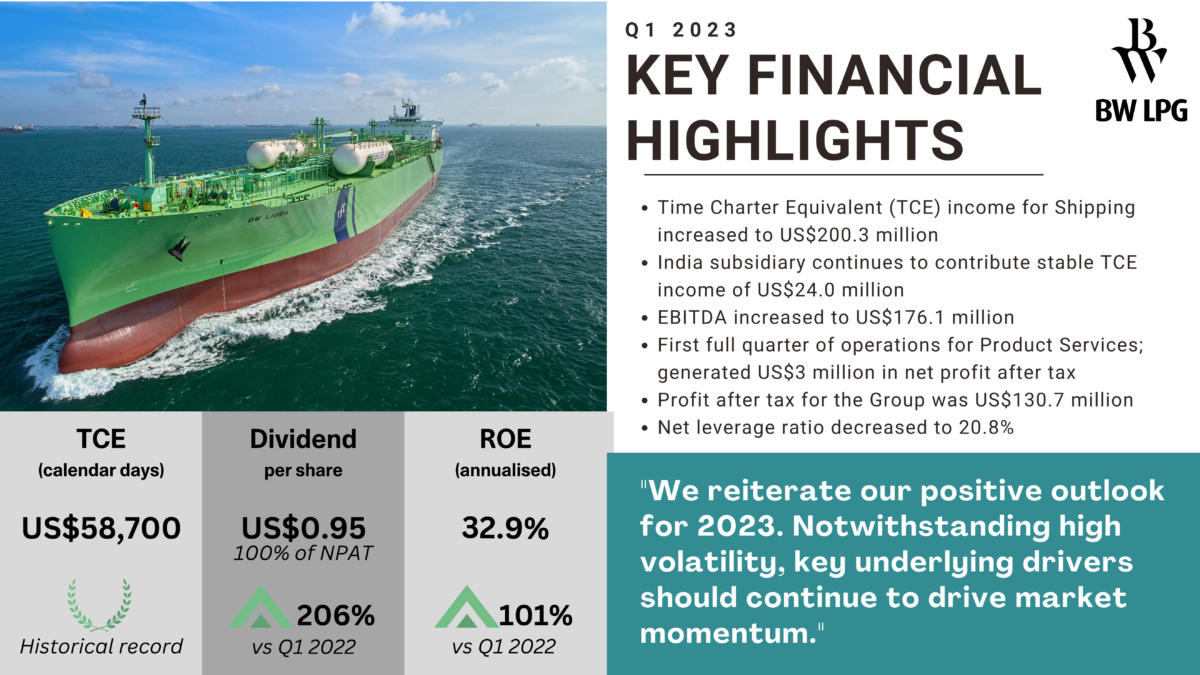

Summary

Our shipping business delivered the highest historical daily TCE on record with US$60,900 per available day, with a commercial utilization of 97%. This is despite taking some cover earlier this year at lower levels, as Q1 is often challenging. The payoff of investing in pioneering technology and retrofitting 15 of our Very Large Gas Carriers (VLGCs) with dual-fuel propulsion engines is now becoming more and more visible. In addition to the environmental benefit of using LPG as fuel, it also makes commercial sense as burning LPG is cheaper than burning compliant fuel. As a result, there is great interest from our customers on our retrofitted VLGCs.

The sale of BW Thor in March generated additional liquidity of US$54 million and a net book gain of US$17 million. Q1 was also the first full quarter of our BW Product Services team. Product Services delivered a net result after tax of US$3 million and traded about one million tons of physical LPG during the quarter. Visit their website here.

In sum, the above activities contribute to our strong liquidity position of US$532 million and net leverage ratio of 21%. And with this liquidity position, we are able to return more dividends to shareholders; for Q1, we announce a dividend of US$0.95 per share, which translates to 100% of NPAT and equals an annualised dividend yield of 44%.

Market Performance

The VLGC freight market performed strongly in the first quarter of 2023: the average spot TCE for the first quarter was US$70,000 per day, historically the second strongest market performance for the first quarter and significantly higher than previous years, surpassing expectations. Initial fears of a market downturn due to poor Chinese PDH margins, global economic outlook, and new vessel deliveries were proven wrong. While there is no certainty that this strong trend will continue, there are at least six reasons to be optimistic:

- Strong US Export Growth: Record-high inventories and expected stability to decline in domestic consumption indicate robust US export potential.

- Sustained Asian Demand: Asian LPG demand remains strong, exemplified by increased run-rates of Chinese PDH plants driven by improved operating margins.

- Market Inefficiencies: Various inefficiencies within the LPG trade, including congestion at the Panama Canal, port delays, weather conditions, and geopolitical/regulatory factors.

- Absorption of Newbuild Fleet: Although 28 VLGCs are still scheduled for delivery in 2023, the impact of this supply growth is expected to be partially mitigated by the drydocking of 36 VLGCs throughout the year.

- Increased Newbuild Prices: Rising prices of newbuild vessels contribute to higher time charter (TC) freight rates.

- Market Dynamics Shift: Notably, a significant shift has occurred in LPG shipping, where traders and oil majors have transformed into ship-owners, resulting in a market increasingly oriented toward long shipping, reducing incentives to drive down rates.

If a slightly longer view of the VLGC market is taken, a significant slowdown in fleet growth in 2024 can be seen, with 14 newbuildings expected to be delivered. Furthermore, considering substantial LPG export expansions in both the US and the Middle East, coupled with shipyards being fully booked until the second half of 2026, this scenario presents promising opportunities in the LPG shipping sector.

Commercial Performance

Our TCE performance for Q1 2023 achieved a new record since our company’s listing in 2013. This strong and volatile market was unexpected – spot rates at the start of the year developed in line with seasonal trends; and conventional data implied that this would continue. As a result, we took cover in TC and the paper market to protect the downside which lowered our performance compared to the overall spot market. Our remaining TC out coverage for 2023 is at 31% with an average rate of USD 38,900 per day and our TC in book for 2023 is covered with a US$29 million profit. For 2024 we currently have 4% coverage, and we see strong demand from the market to fix 2-3 years’ time charterers at historically strong rates. Our LPG retrofit ships are popular due to their fuel efficiencies and can obtain 13-15% unlevered returns for TC contracts.

For the second quarter of 2023, we have booked 90% of our available fleet days at an average rate of US$50,000 per day. The lower fixed Q2 number compared to Q1 is due to the market dip we saw in March and April. The current spot market is on average, US$80,000 per day. So we expect to finalise the remaining days of Q2 on a strong note. The FFA market for Middle East, Japan indicates TCE at mid-to-high US$50,000 per day for the remainder of the year.

Financial Performance

On a consolidated basis, we reported a total of US$225 million in gross profit for Q1. This was largely driven by the strong TCE earnings from our shipping segment on the back of the sudden reopening of China with low inventories. EBITDA came in at US$176 million, which represents an EBITDA margin of 78%. This brings us to a full year net profit after tax of US$131 million, US$3 million of which came from our Product Services segment. Our net leverage ratio came in at 21%, just above our 20% guidance for a payout of 100% of NPAT. Nevertheless, our Board has still decided to declare a Q1 dividend of 95% per share, equating to a pay-out ratio of 100% of NPAT.

Our VLGC fleet generated US$200 million in TCE income or US$58,700 per calendar day for the quarter, which is a historical record high. Daily OpEx came in at US$8,600 per day, largely due to higher maintenance and repair expenses. Our shipping segment ended the quarter with a profit after tax of US$128 million. For 2023, we expect our operating cash breakeven for our total fleet, including our chartered-in vessels to be at US$23,100 per day. Shifting focus to our expanded Product Services business. In Q1, we traded approximately 1 million metric tons of physical LPG, generating US$25 million in gross profit. Depreciation relating to the amortization of five right-of-use (ROU) assets was US$18 million, resulting in a US$7 million EBIT for this quarter. Other expenses comprised of the interest component of the ROU liabilities, G&A expenses and estimated taxes approximates US$4 million for the quarter.

Net of depreciation and other expenses, our Product Services business reported a profit after tax of US$3 million this quarter. Our trading portfolio reflected an average daily value at risk of about US$5 million for Q1 based on the standard 95% confidence level. Our committed capital in this business remains unchanged at US$100 million, which includes US$50 million in a revolving working capital facility used mainly to finance margin calls on our paper hedges. Product Services will continue its conservative short-term approach to the market while we prepare for an activity ramp up in the medium term.

On corporate actions, the Board has also resolved to initiate a new share buy-back program for the purchase of shares up to a maximum of US$50 million. Details on execution will be provided when the new share buy-back program is launched.

Outlook

We continue to remain positive, but expect volatility to remain. The current oil price is conducive to continued strong export growth from the US and steady growth from the Middle East. We also see that margins for Chinese PDH plants have been improving, which is important for LPG demand. Further, we expect fleet inefficiencies to continue to lend support to rates. 36 VLGCs are due to drydock from June to the end of 2023 and waiting times at the Panama Canal are likely to increase as the world’s merchant fleet expands in the coming years. Recently announced capacity expansions for US LPG export terminals also enable more LPG to be shipped in the years ahead.

Our Strategy

Our strategy remains steadfast: We want to build a robust, returns-focused company by actively searching for attractively priced investments in shipping as well as LPG trading and onshore infrastructure projects. BW LPG pioneered dual fuel LPG propulsion technology with our retrofitting program, and this is allowing us to enjoy fuel savings of approximately US$5,000 per day. We remain strong believers in LPG dual fuel technology even as we closely monitor technical developments on the ammonia side. As always, we will continue to look for opportunities to create shareholder value through attractive asset play transactions as well as using our time-charter portfolio and derivatives to adjust our market exposure.

Read More:

Keywords: earnings, presentation, financial performance, maritime, shipping, forward-looking, LPG, VLGC, LPG Trading