Summary

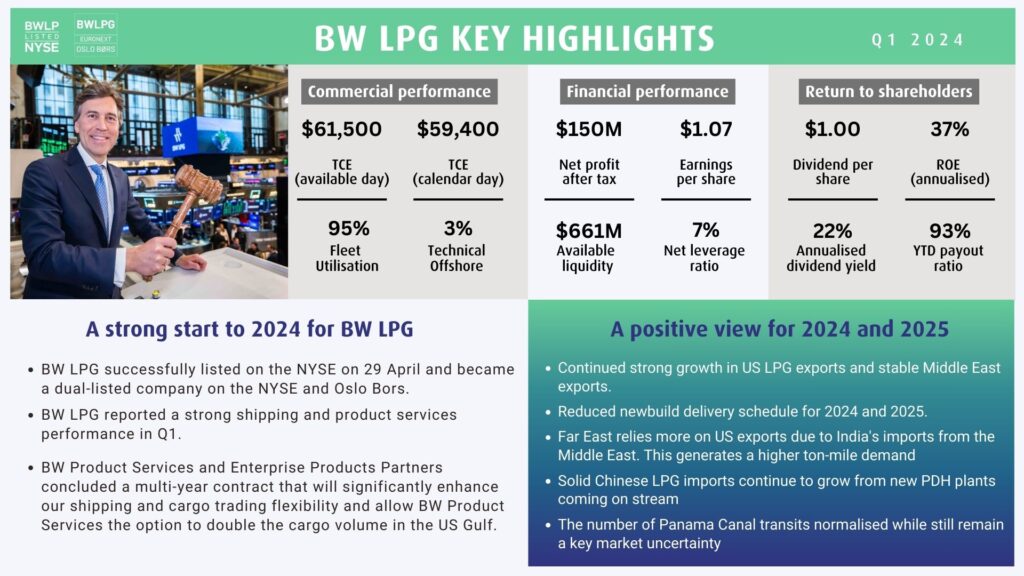

We started 2024 with solid results for 1Q. We achieved a net profit of USD 150 million for the quarter and on the back of strong performance from our shipping and product services business units, we are pleased to announce an above- consensus dividend of USD 1.00 per share. This represents 106% of earnings from our shipping activity and 93% of total earnings. It also reflects our commitment to creating shareholder value to our shareholders.

BW LPG is now listed in Norway and New York, trading under ticker codes BWLPG and BWLP respectively. From all of us at BW LPG, we thank our stakeholders for their continued support and trust. We look forward to engaging closely with investors and market participants in exploring new opportunities to build our business. CEO Kristian Sorensen and CFO Samantha Xu discussed our Q1 results during our earnings presentation held on 30 May 2024. A copy of the recording, together with our earnings presentation and Q1 interim financial report are available below.

Q1 2024 Earnings Presentation

Download our earnings presentation here.

Q1 2024 Interim Financial Report

Download our interim financial report for the quarter here.

Q1 2024 Earnings Presentation Recording

Watch a recording of our earnings presentation for the quarter here.

Q1 2024 Presentation Q&A Recording

Hear a recording of our earnings presentation Q&A for the quarter here.

Q1 2024 Earnings Presentation Transcript

Download the transcript of our earnings presentation for the quarter here.

Continued Strong LPG Story

We maintain our positive view on the sector with several indicators pointing in the right direction, both in the underlying LPG commodity market as well as the supply/demand balance in the VLGC market, even without disruptions in the Panama Canal. The US production and export volumes are still the locomotives of the LPG growth story and continue to deliver on the upside of expectations. According to recent EIA figures, the production and export volumes are up 8% and 14% respectively year-to- date compared to same period last year and we maintain our positive view on the US export volumes for 2024-2025. We regard the CAPEX plans by the US terminal companies as a positive sign for the future US LPG export volumes and believe they will remove any potential bottle necks for the medium term.

The Middle East exports are expected to be stable for this year unless OPEC decides on any cut back reversals, while we anticipate more volumes to come on stream from next year onwards from Abu Dhabi and later Qatar. The increasing LPG exports from the US and the Middle East are meeting a growing demand side in Asia, both for industrial purposes, well represented by rapidly increasing demand by the Chinese PDH plants, and from the residential sector, especially in the Indian sub-continent and Southeast Asian countries. The Indian demand for LPG is now consuming about half of the Middle East exports, making the rest of the Asian market increasingly dependent on US LPG exports to meet the underlying and higher demand which follows growing population and prosperity.

It is worthwhile to note is that LPG, by being a byproduct from oil and natural gas production, has a history of always being priced to clear and eventually finding a home since no producers want to store LPG for a prolonged period. And this market dynamic makes it a competitively priced energy source which easily penetrates new markets since it is relatively easy to handle compared with other energy sources which require much higher infrastructure investments.

Looking at the global VLGC fleet balance for the next 18 – 24 months, it is a sharply abating curve of newbuilding deliveries when we move into the second half of this year. We only have a handful of VLGCs set for delivery from the yards while the global fleet is approaching 400 units. For 2025 only a dozen vessels are scheduled for delivery. Yards are still talking deliveries for new orders more than three years forward and this gives us good visibility of the market for the next 18-24 months.