Summary

Today, BW LPG announced its Q3 2025 financial results.

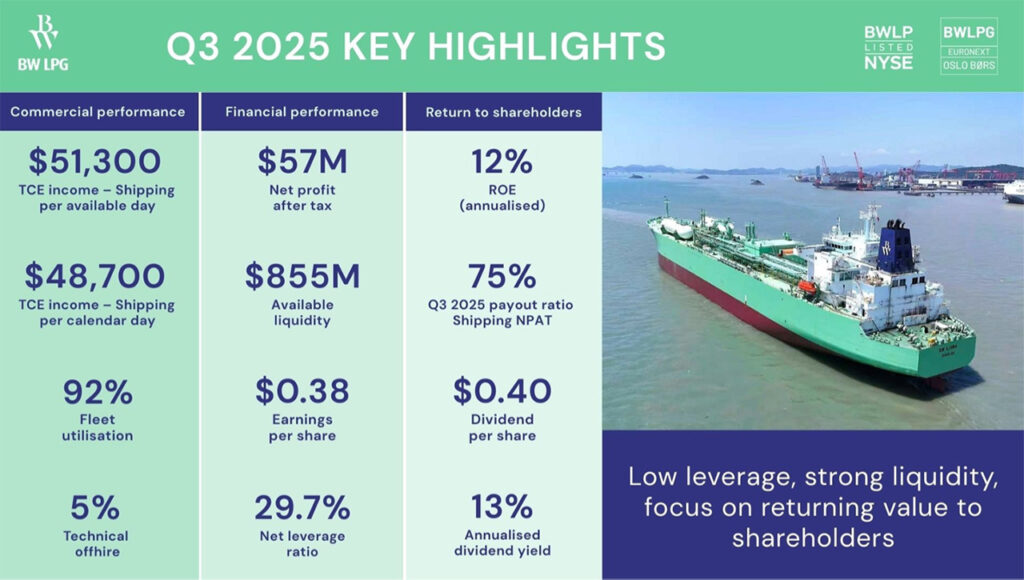

We are pleased to report a Q3 2025 Net Profit After Tax (NPAT) of US$57 million, yielding an annualised return on equity of 12%. The Q3 profit attributable to the equity holders of the company was US$57 million, and earnings per share were US$0.38. The Board declared a dividend of US$0.40 per share, representing a 75% payout ratio of the quarterly Shipping NPAT in line with the dividend policy.

For our Commercial Performance Shipping, we are glad to announce a solid Time Charter Equivalent (TCE) income for Q3 2025, averaging US$51,300 per available day, with 92% fleet utilisation.

Q3 2025 Earnings Presentation

Download our earnings presentation here.

Q3 2025 Interim Financial Report

Download our interim financial report for the quarter here.

Q3 2025 Earnings Presentation Recording

Watch a recording of our earnings presentation for the quarter here.

Q3 2025 Earnings Presentation Transcript

Read the transcript of our earnings presentation for the quarter here.

Q3 2025 market update and outlook

Market Update

Geopolitical development and market inefficiencies continued to shape the LPG shipping market in Q3. Actions by both US and Chinese authorities prompted VLGCs repositioning and created a two-tier market, while the Saudi LPG price cut in October triggered a price reset across the value chain.

Spot rates remained elevated through the quarter, though periods of limited fixing activity occurred before normal trading conditions resumed following the temporary suspension of US-China trade tariffs and port fees. Market fundamentals remain constructive, supported by US terminal expansions coming onstream and increased LPG output from gaseous drilling wells

Cargo Movements

US LPG exports shipped on VLGCs increased by nearly 6% in the first nine months of 2025 compared to the same period in 2024. US exports bound for China have been rising steadily since their low in May 2025 but remain well below levels seen before the two countries’ trade tensions erupted.

From the Middle East, LPG exports on VLGCs grew 1% in the first nine months of 2025 compared to the same period in 2024. OPEC+ has announced a minor oil production increase to take effect in December, with limited impact expected on LPG export volumes. For Q1 2026, OPEC+ has paused further oil production increases, helping to stabilize oil prices at current levels and indirectly supporting US production. A prolonged decline in oil prices could ultimately weigh on US oil and NGL output.

On the importing side, LPG volumes shipped on VLGCs to the Far East were flat in the first nine months of 2025 compared to the same period in 2024. Trade tensions between China and the US contributed to a modest (2%) decline in Chinese LPG imports, while other Far Eastern countries grew their imports. During the same period, Indian LPG imports on VLGCs increased by 8% year over year, supported by higher end-user demand for LPG.

Panama Canal

The new locks in the Panama Canal continue to operate at or near full capacity. Fluctuations in container-vessel traffic through the canal have, on several occasions, redirected VLGCs to sail around the Cape of Good Hope rather than transiting the canal. With continued fleet growth in several shipping segments, including container vessels, ethane carriers, and VLGCs, high utilization of the canal’s new locks is expected to persist in the coming years.

Fleet Capacity

The VLGC fleet currently stands at 413 ships, with an orderbook of 108 vessels. Year to date, 11 new VLGCs have been delivered, with one more scheduled before the end of 2025. For new orders, well-established shipyards are indicating earliest delivery slots from 2028 onwards. Notably, 43 VLGCs—representing 10% of the existing fleet are 25 years or older.

Market Outlook

Following the easing of trade tensions between the United States and China, inefficiencies in the VLGC fleet are expected to diminish as trading restrictions on US- and China-linked fleets have been lifted. This improved trading environment should result in a modest increase in available VLGC capacity. Meanwhile, the broader fundamentals of the LPG shipping market remain constructive. US production continues to expand, and ton-mile demand is likely to benefit from recently signed long-term agreements by Indian importers for US-sourced LPG, as well as renewed supply contracts with Indonesia.

North American LPG exports are projected to grow at a mid- to high-single-digit pace over the coming years, supported by new export infrastructure and the increasingly gas-rich profile of Permian oil production.

Exports from the Middle East are also expected to rise meaningfully, driven by higher oil output and the commissioning of new gas processing facilities in the UAE and Saudi Arabia.

In China, average operating rates at PDH plants have recovered from the lows earlier this year, though recent weeks have seen some softening due to margin pressures. LPG inventories remain healthy and stable heading into the fourth quarter. While no new PDH plants are scheduled to commence operations for the remainder of 2025, nine additional facilities are planned for construction over the next two years.

The Ras Tanura–Chiba FFA market for FY 2026 is currently pricing earnings just above US$45,000 per day, though trading activity remains relatively limited.